Cost of borrowing on bond market inches-up

The cost of government financing on the secondary bond market has been on the rise since the third quarter of 2021, with yields rising more broadly across the curve ahead of the start of the US Fed taper timeline which begins next month.

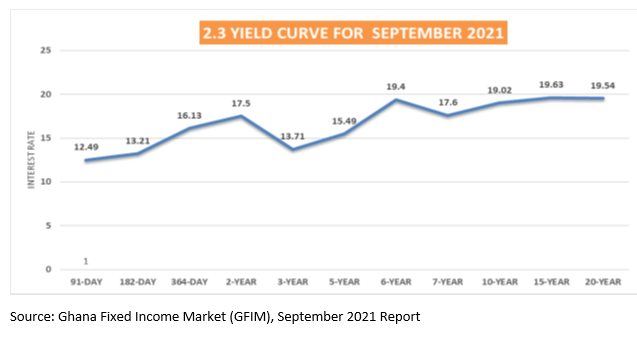

On the Ghana Fixed Income Market, yields are on the ascendency – with the two-year Treasury note rising from 15.33 percent in August 2021 to 17.5 percent in September 2021. Medium-term maturities: the three-year, five-year, as well as six-year, and seven-year, also rose from 13.29 percent, 13.48 percent, 18.51 percent, and 17.6 percent in August to 13.71 percent, 15.49 percent, and 19.4 percent respectively in September 2021.

Long-term bonds: 10-year, 15-year similarly increased to 19.02 percent and 19.63 percent in September 2021 from 18.91 percent and 18.22 percent in August respectively. However, the 20-year bond remained unchanged during the period at 19.54 percent.

From a borrowing requirement perspective, there will be a sharp tightening of financing conditions, resulting in a significant premium on the cost of government borrowing as well as other borrowers on the market.

Senior Economist with Databank – an assets management company, Courage Kingsley Martey, said yields have been under upward pressure since the late third quarter, especially beginning September 2021; largely due to the cedi-liquidity crunch as well as the US Fed Taper, which is set to be next month.

Latest Posts

157TH Canada Day Celebration: Celebrating Strong Bilateral Trade between Canada and Ghana

July 01, 2024

FATHER’S DAY DINNER WITH PRINCE KOFI AMOABENG

July 01, 2024

FREIGHT FORWARDERS AND LOGISTICS SECTOR MEETING

July 01, 2024

Celebrating Women at the Mother’s Day Dinner

June 03, 2024

CANCHAM Pharmaceutical Sector Meeting Highlights

June 03, 2024

In-house Presentation (May Edition)

June 03, 2024

CANCHAM ANNUAL GENERAL MEETING

May 08, 2024

Construction Sector Meeting Hosted by CANCHAM

May 08, 2024

INDUSTRIAL TOUR TO MERIDIAN PARK BY LMI HOLDINGS

May 08, 2024

A JAZZ AND WHISKY AFFAIR: A Tri-Chamber Collaboration!

May 08, 2024

May 08, 2024

EMPOWERING THE FUTURE: ALINEA FOUNDATION’S WEE-NORTH PROJECT AGM

April 04, 2024

EMPOWERING CHANGE: CANCHAM AND JOY BUSINESS INTERNATIONAL WOMEN’S DAY DIALOGUE

April 04, 2024

April 04, 2024

EXPLORING FLAVORFUL HORIZONS: A JOURNEY WITH FREDDIE BEVERAGES

April 04, 2024

EXPLORING HORIZONS: INSIGHTS FROM HOLLARD INSURANCE’S JOURNEY

April 04, 2024

UNLOCKING OPPORTUNITIES: SENA CHARTERED SECRETARIES LIMITED’S EXPANSION ENDEAVOR

April 04, 2024

Highlights from CANCHAM Chocolate Day Member Forum 2024

March 01, 2024

TVET Workshop by Canadian High Commission in Collaboration with CANCHAM

March 01, 2024

Unlocking Potential: Insights from Asante-Chirano

March 01, 2024